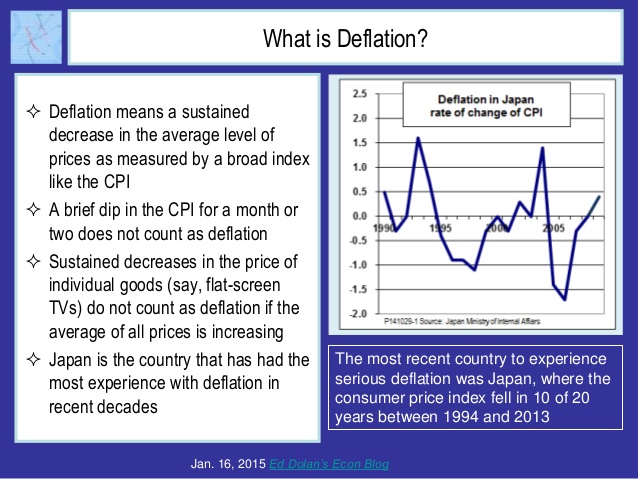

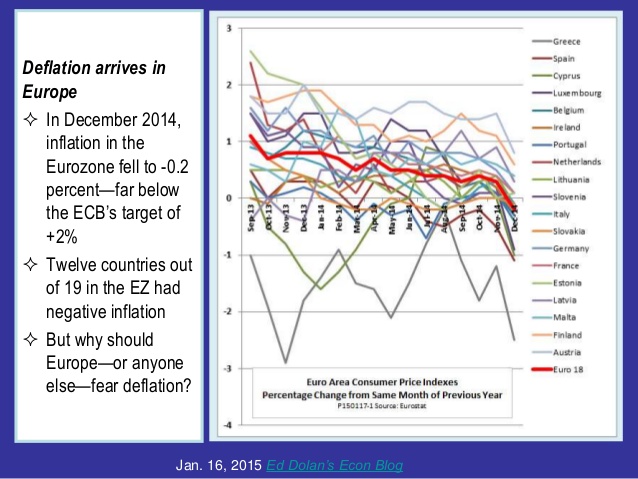

Though deflation has never really been an issue in the United States, it remains a relevant concept globally and theoretically. Most recently, Venezuela and Russia have both experienced negative growth and currency devaluation. Wait, what is deflation? Ed Dolan's economics blog brings you some slides (full show here) explaining deflation.

For laymen, the CPI is the Consumer Price Index, and is supposed to reflect generally how the prices of things are changing. That said, there are some valid critiques of the CPI, such as the fact that it doesn't include gasoline prices. The opposite of deflation is inflation, which happens yearly and is an important part of a smoothly functioning and growing economy. The term "inflation" has negative connotations mainly due to people mistaking inflation to mean hyper-inflation. This is the kind of scenario seen after major world events, such as losing a war, where people bring wheelbarrows of cash to buy a loaf of bread because their currency has become so undervalued. Higher inflation often means the economy is growing fast. But anyway, back to deflation. Japan has had some problems with deflation for reasons I will explain in a minute.

But, how could deflation be a bad thing? It just means that prices are decreasing. Well, there are some larger effects on the economy and governmental control (because government really needs more control, right?).

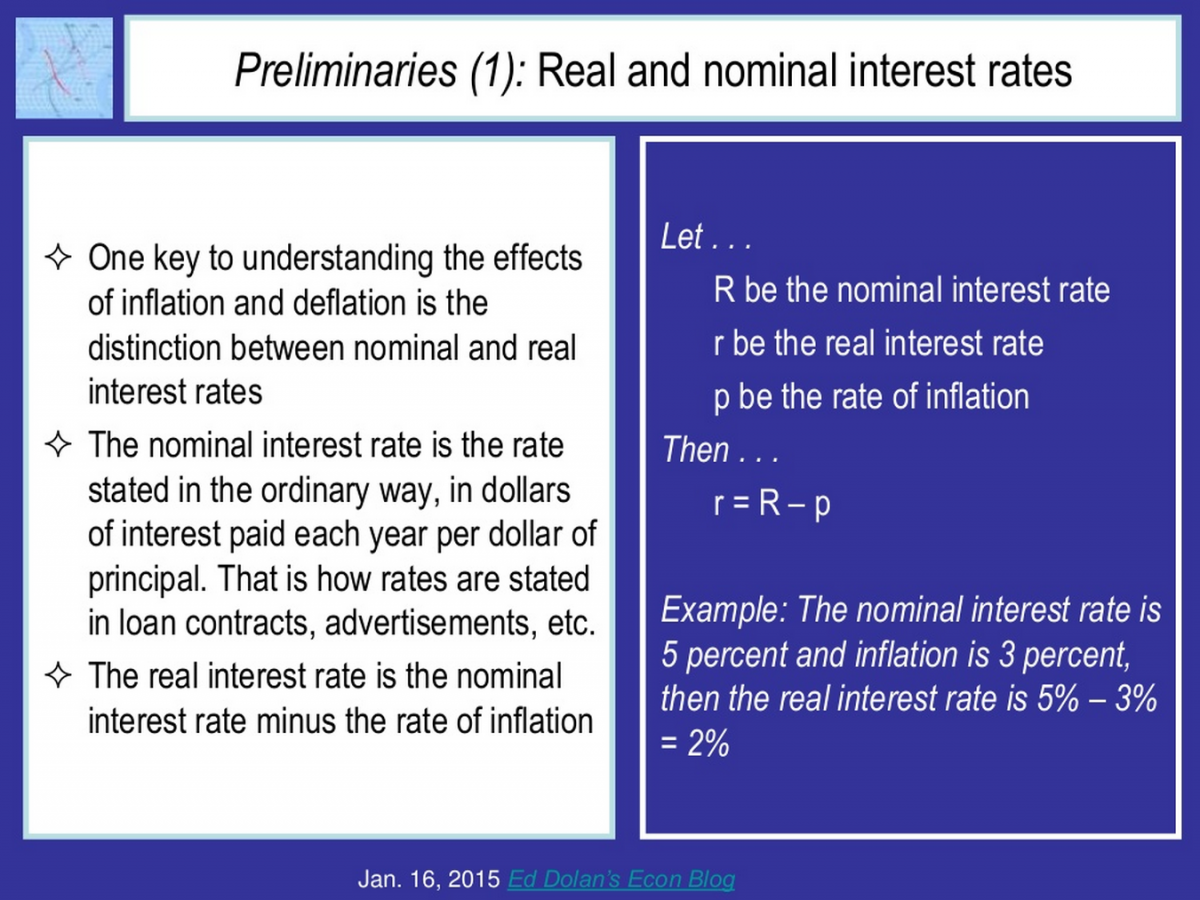

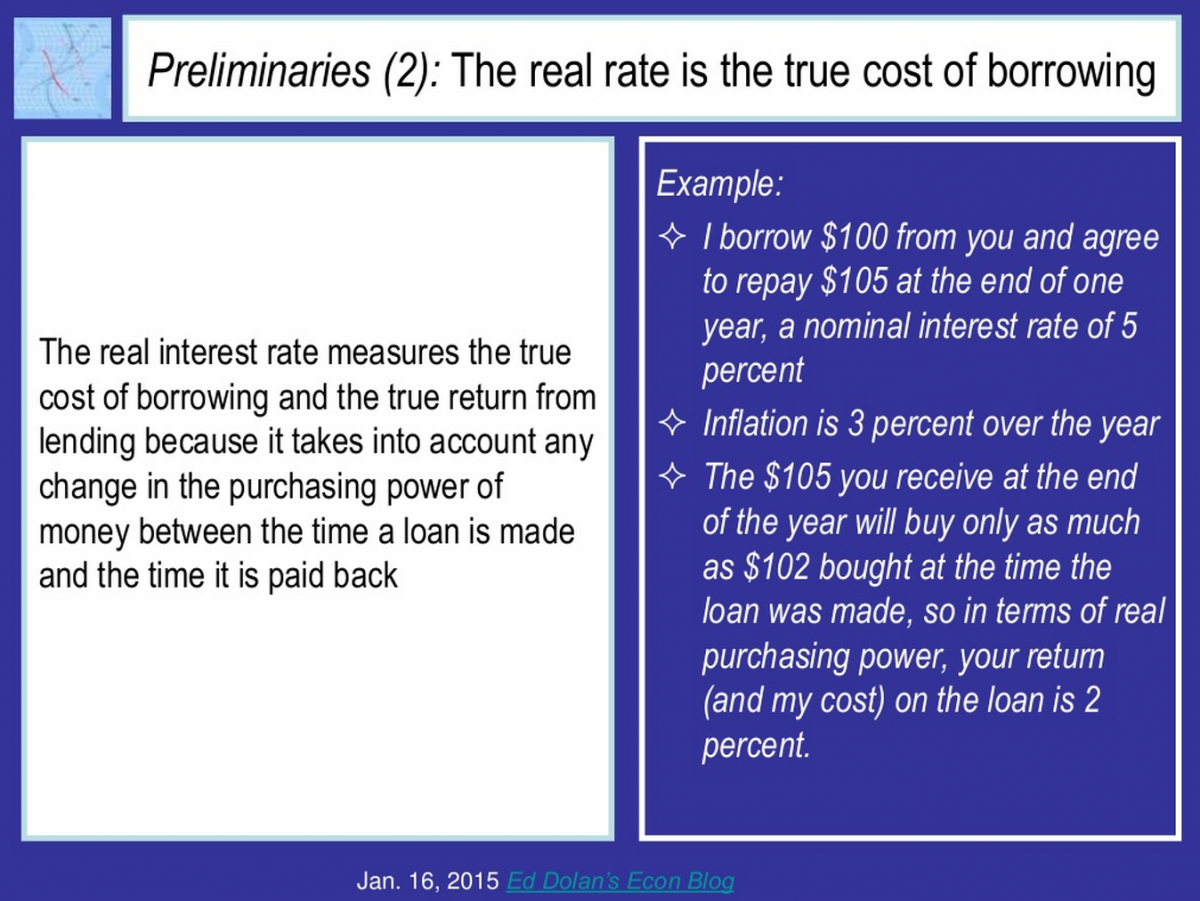

I won't deceive you. The distinction between nominal and real is SO simple, yet I frequently confuse the two. Nominal anything is the actual, posted, number version of that thing. So, nominal GDP from 1970 is the dollar amount GDP was then. Real anything is the inflation-adjusted number of that thing. Do you see why this is confusing? One would ASSUME that the "Real" number is the price on the sticker, the advertised loan rate, the GDP number they tell you. I have spent a lot of time thinking about why on earth they didn't call nominal "real" and "real" "inflation-adjusted" or something descriptive. Anyway, the inflation-adjusted, or real, value is important because if there is a lot of inflation or deflation, you can think you are paying or making a different amount of money than you actually are (Slide 2).

Real Interest Rate = Nominal (Posted) Interest Rate - Inflation

If deflation occurs, the rate of inflation will be negative. Rules say that nominal interest rates cannot be below zero, where you would be paying the lender to let you give them money. However, if the rate of deflation offsets or is greater than the nominal rate, the real interest rate will rise, and no one will want to borrow money. This is the main concern on an individual level about why deflation is bad.

Another effect of deflation upon people is through wages. When inflation rises, people are more than happy to get a nominal wage increase to match, even though they still have the same amount of money after inflation. On the other hand, if deflation occurs and employers respond with a nominal wage increase, people are very unhappy. They still have the exact same amount of purchasing power, but maybe they don't understand the difference between nominal and real. Understandable, honestly. If you have workers in a union, you usually can't reduce their wages (contractually). If they're unionized, workers may pout or quit.

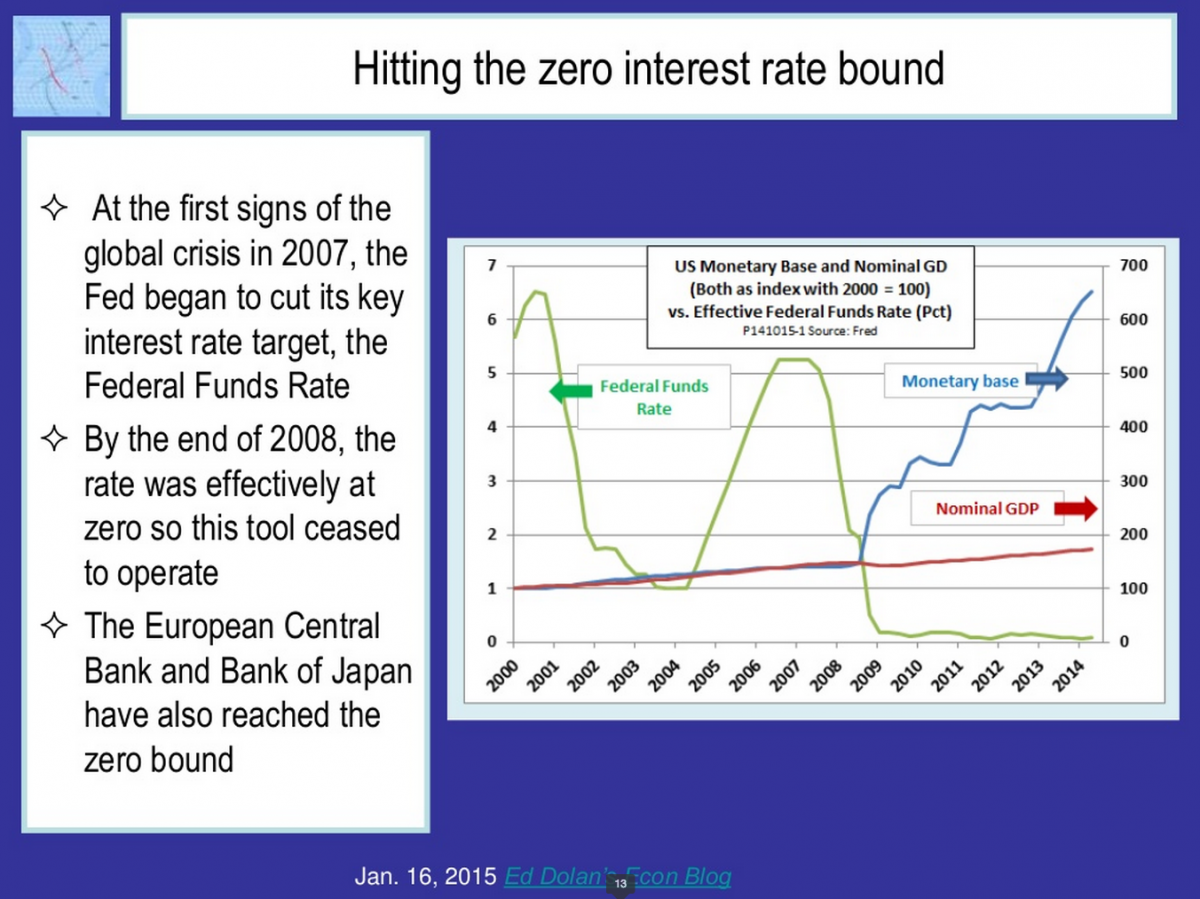

The most important effect of deflation is upon the efficacy of central bank policy. I could feel you fall asleep a little during that sentence, but hang in there with me. Usually, central banks try to mitigate the effect of recession or reign in wild growth using interest rates. When rates are high, people don't want to borrow, and when they are low, they do. Simple enough. Central banks can also print more money or retire money to change and monitor the value of a currency. A problem arises, however, when banks hit the "zero bound". If a bank has been trying to stimulate the economy by cutting interest rates repeatedly, it will eventually face a zero or near-zero interest rate. As the country remains in recession, suddenly the central bank has no more tools to push the economy in the right direction. People have no interest in buying bonds, as they are worth the same as cash money ($$$, y'all). They are caught in what is known as a "liquidity trap". Expansionary efforts have failed. Japan has been in a liquidity trap for a while now. Their growth (both population and economic) has stagnated, and the bank has little to no control over it.

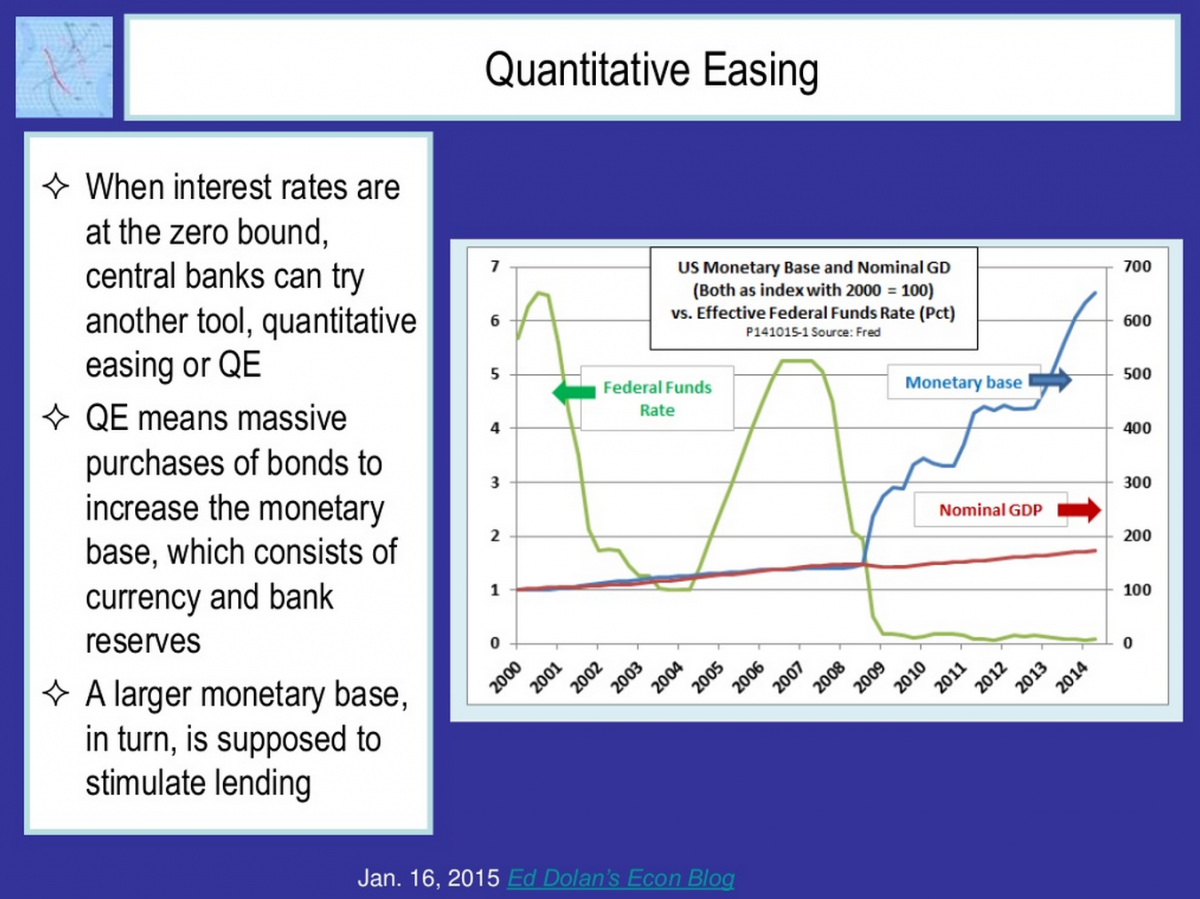

If this interests you, Paul Krugman loves to talk about liquidity traps. Now, if you're familiar with any of the stuff the Federal Reserve has been up to in the last few years, you know that they haven't been just cutting interest rates to try and move the economy. The US Fed has participated in quantitative easing in a novel effort to improve the economy.

Quantitative easing involves the Fed buying billions of dollars worth of bonds with money they create out of nowhere. Creating more money is one of their instruments of control, it's just that in this case, they used that money to buy a TON of bonds. In this case, creating all this money didn't cause inflation, because they weren't actually printing money. From an article written during the era of QE to explain this magic trick:

"This claim demands more explanation so let's use the current $85 billion dollar per month QE program as an example. When the Fed creates $85 billion, it uses this money to buy bonds - typically split 50/50 between US Treasuries and Mortgage Backed Securities (MBS). Here is what's important: When the Fed creates and gives $85 billion in reserves to its member banks, it removes $85 billion worth of assets (bonds) from the balance sheets of those same member banks. The result is that no new net financial assets enter the economy. This bears repeating. Every time the Fed injects $85 billion in reserves (assets) into the economy, it removes $85 billion worth of assets from the economy. This process is not a one way flow of money into the economy, as interpreted by some."

The money supply wasn't increasing, only the Fed's balance sheet was! The massive scale of the program is why the whole of the financial world sits around anxiously before Janet Yellen, chairwoman of the Federal Reserve, announces any potential changes to the bond-buying (quantitative easing, or QE) program. Seriously, you have bankers and bond traders acting like 7th grade girls trying to interpret a text from their crush.

"Ok, so Yellen said 'soft forward guidance', does that mean the Fed isn't tapering* yet, or that she moisturizes her hands really well?"

*Tapering, in this case, means reducing the amount spent on the QE program.

"I solemnly swear I am up to no good"

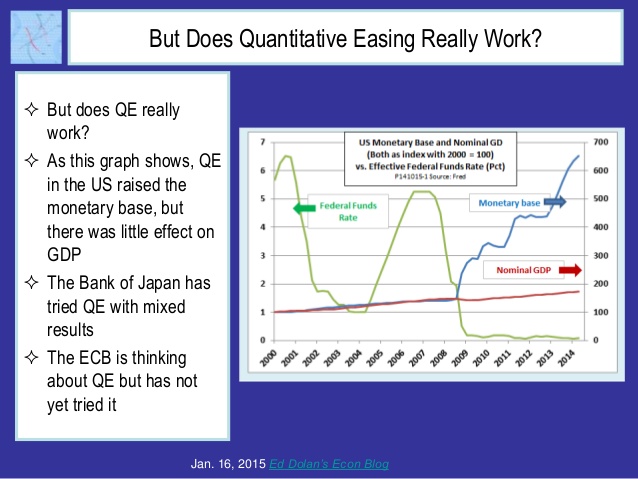

Despite the massive amount of money that has been spent on QE, there is no evidence that it actually had any effect other than raising the morale of the finance professionals who caused QE to be needed in the first place. Some criticize QE as having been a policy that simply rewarded the finance world and falsely propped up their balance sheets as they licked their wounds. Conversely, here is a defense against aforementioned critique. The most common response to concerns that QE increased inequality is as follows.

"Richard Barwell of RBS said any policy that was successful at pulling an economy out of a slump would ultimately appear to increase inequality. Even if all wages in an economy grew by the same amount, the mere process of raising expectations of future profits would increase equity prices and so give more money to the already rich, he argued.

“Given an unequal distribution of income and wealth it is always likely to be the case that a policy which generates a robust and sustained recovery will benefit those at the top more than those at the bottom,” Mr Barwell said." -FT, October 21, 2014 (pay-walled)

The program ended in October of 2014, resulting in $4.5 trillion of accumulated assets. Now, finance professionals eagerly await a Fed announcement that indicates they will begin selling these assets.

"Well, boss, Yellen said they will begin liquidating, which we take to mean that they are going to sell the bonds.... or maybe they needed a bathroom break."

Full slideshow available here.

Money represents a social agreement, which has implications for how we value wealthy people. Bitcoin replaces the need for this social agreement with technology, and in doing so challenges the values we ascribe to wealth.